The circus continues. The carnival barkers are screaming at us about Russia and Fake News. Democrats, including Clinton and Schumer, are demanding that Trump and his administration be opposed on everything they do. Trump takes on the Press, forcing reporters to focus on protecting their own.

It is all a distraction. The REAL story is, as usual, about the dollars.

The Trump administration has come out blazing with lots and lots on their plate. Disruption is the main dish, with Obamacare and Immigration and Trade and Tax Reform piling onto the plate along with dozens of other issues piling up and spilling over. It is impossible to keep track of it all. And that is the point.

The stock market is soaring. This is no surprise. The market has priced in tax reform, which promises to lower corporate rates significantly. This is very good for businesses, and this has been reflected in stock prices. The market is also excited about the prospect of the Infrastructure Stimulus bill, and increased spending on Defense, and they have priced those expectations into the market as well.

Business leaders are thrilled, the market is soaring, and we are going to get tax cuts and infrastructure spending and defense spending and all kinds of other goodies. Why wouldn’t everyone be happy?

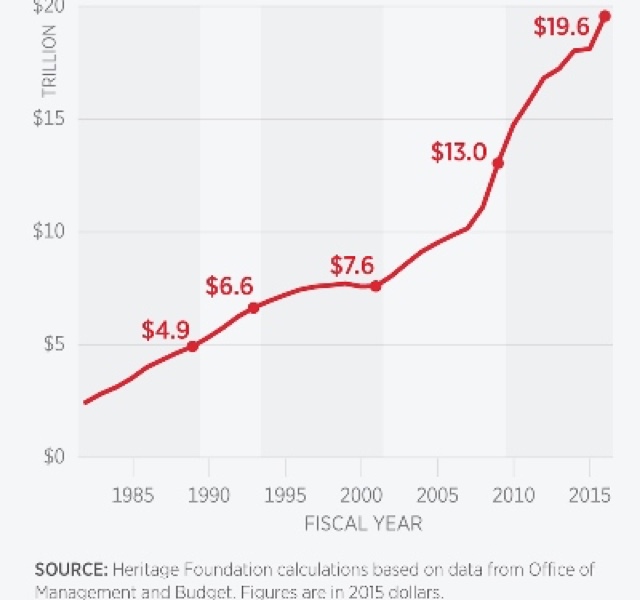

I hate to be the bearer of bad news, but there is no magic budget wand. The US federal government is $20 trillion in debt and that debt continues to grow at a blistering pace. Business leaders and the stock market are concerned with the prices of stocks and which way they will go. They care about their company’s bottom line, but the federal budget deficit is not their concern.

Tax Reform is front and center right now and the talk is about how far to lower corporate tax rates. The problem with lowering rates is that revenues drop. Many will argue that lowering rates increases revenue. Ronald Reagan and John Kennedy both lowered rates and saw an increase in revenue as a result. Art Laffer described this phenomenon with his “Laffer Curve”, and the idea is valid in a specific range of conditions. However, there are obvious limits. Dropping rates does not always result in more revenue and the farther you cut the less likely you are to increase tax revenue.

In order to pass tax reform it is going to need to be deemed “revenue neutral”. The best way to get to revenue neutrality is to cut deductions and credits and subsidies as you lower rates. This is true tax reform. But another way to get a better score is to assume more robust growth in your economic forecasts. Increasing your expectations reduces the need to make hard choices about eliminating the cronyism that clogs our tax code.

Dynamic scoring is valid, but in mathematical terms it introduces more terms, and more variables, to the equation. The key is in how closely you estimate those variables. Predicting future economic conditions is always tricky but in the hands of politicians it becomes a political exercise.

Voters expected the Congress which had voted to repeal Obamacare to do so quickly after the election but that has not happened. Republicans have put health care reform on the back burner because they realize there are popular elements that need to be kept like pre-existing conditions and staying on your parent’s policy until 26. They also would like to get rid of the individual mandate. Unfortunately the “good stuff” costs money and the “bad stuff” brings in revenue.

Many states expanded Medicare as part of Obamacare and if the federal government drops the ACA those states will have quite a problem. The program was cobbled together in a tenuous manner that never really worked, and unwinding it will now have costs associated with dropping it, not to mention still having a problem with uninsured citizens.

One way to fill the budget gap, at least on paper, would be to implement a border tax. Taxing imports from other countries would have a chilling effect on trade, and Americans would pay higher prices for goods. One would expect that countries we impose a border tax on would respond in kind, making our goods more expensive to sell outside the US. But the border tax would provide funding to the federal government, and that is why they are talking about it.

Business leaders have been streaming in and out of the White House, thrilled about the tax cuts but also excited about getting to work on a host of new infrastructure projects that the federal government is looking to take on. New bridges and roads and electric and water and communication grids will be rebuilt and improved. Of course they are excited.

One way to cut spending would be to cut entire departments from the federal government. It has been estimated that eliminating three of those departments - Education, Energy, and Commerce - could save as much as $120 billion per year. Of course, that would be the complete elimination of three cabinet positions and would only save less than a third of our current deficit, much less all of the increased spending on Defense and Infrastructure.

We are going to build a wall, and we are already hiring 10,000 new border agents. The wall will cost somewhere around $12 billion. When Trump said Mexico would pay for the wall, he was referring to the border tax. The cost of the border tax will be borne by those who buy imported goods.

We cannot lower taxes and increase spending and lower the deficits or pay off our debt. That is not possible, even with dynamic scoring.

What will now follow are “negotiations” in Congress. Republicans in the House and Senate understand the reality that is the federal budget. If you have not noticed, they have not been particularly conservative fiscally. They will all be horse trading to get stuff for their favorite crony constituencies, just like always. Goodies for Boeing are not suddenly going to be removed from the table.

We are still running a budget deficit and we are still racking up debt. Not a single department has been eliminated. We are not passing spending bills in regular order, despite having the House and Senate and White House. The last Budget passed included massive spending and despite the rhetoric there have been no changes. We are still spending like drunken sailors.

If Republicans move forward the way Democrats did, passing major legislation with zero Democrat support, then they will end up with the same disaster the Democrats did. Looking at the level of discourse in our country right now I cannot see much of a bipartisan effort.

The distractions are there on purpose, from Twitter to the Immigration orders to the war on the Press; PT Barnum wants you to look at certain things and not others. What he certainly does NOT want anyone looking at is the deficit or the hard budget choices that Congress is going to need to negotiate.

Being pro-business does not make one a fiscal conservative. Being pro-business is not the same as being pro-free markets.

Republicans in Congress do not have a good record of fiscal conservatism. The president has not shown much promise in that area either. And that is no surprise. If you want to be a popular president, in fact a rock star, simply come in and lower taxes and spend like a drunken sailor. Everyone will love you. The stock market will rise. People will have health care. Our infrastructure will be rebuilt. We will build up our defense.

And we will simply hand the bill to our grandchildren.

No comments:

Post a Comment